Based on the search results, the PVC industry is currently experiencing significant market pressures, primarily from overcapacity and changing demand, while also being pushed toward more sustainable and high-value production. These challenges create clear strategic directions for us.

Here is a summary of the key challenges we face and the corresponding efforts we should prioritize.

| Challenge / Pressure | Primary Effort & Strategic Direction | Key Focus Areas & Examples |

|---|---|---|

| Severe Market Oversupply | 1. Differentiate and Move Upmarket | Develop high-value specialty resins (e.g., medical, electronic grade) and tap into new growth markets (e.g., solar panel backsheets, semiconductor materials). |

| Stringent Environmental & Sustainability Pressures | 2. Drive Green Transformation | Replace toxic additives (lead, mercury); Optimize energy use (e.g., oxygen cathode tech); Invest in recycling and circular economy technologies. |

| Increasingly Complex Trade Environment | 3. Strategically Navigate Global Markets | Achieve international certifications (e.g., BIS); Diversify exports to emerging markets (e.g., Southeast Asia, Africa); Prepare for trade barriers (e.g., EU anti-dumping duties). |

| Weak Downstream Demand & High Costs | 4. Enhance Internal Competitiveness | Pursue technological cost reduction (e.g., lower calcium carbide consumption); Optimize production processes with automation and AI. |

🏭 A Closer Look at Market Realities

The core market challenge is a classic “ice and fire” situation: positive policy expectations clash with a weak fundamental reality.

-

The “Fire” of Overcapacity: The industry is grappling with severe low-end, homogeneous overcapacity, with an estimated excess rate of 18%. In 2025 alone, hundreds of thousands of tons of new capacity were brought online domestically and globally, intensifying competition and suppressing prices.

-

The “Ice” of Sluggish Demand: The largest traditional market—real estate and construction—remains in a downturn, directly suppressing demand for pipes and profiles. This has led to high industry inventory levels and a “buy as needed” mentality among downstream customers.

🔬 Moving from “Volume” to “Value”

Breaking out of the low-end competition cycle requires a fundamental shift in product strategy.

-

The High-End Gap: While low-end products are oversupplied, the domestic production rate for high-end specialty resins (like medical and electronic grades) is less than 30%, indicating a major opportunity.

-

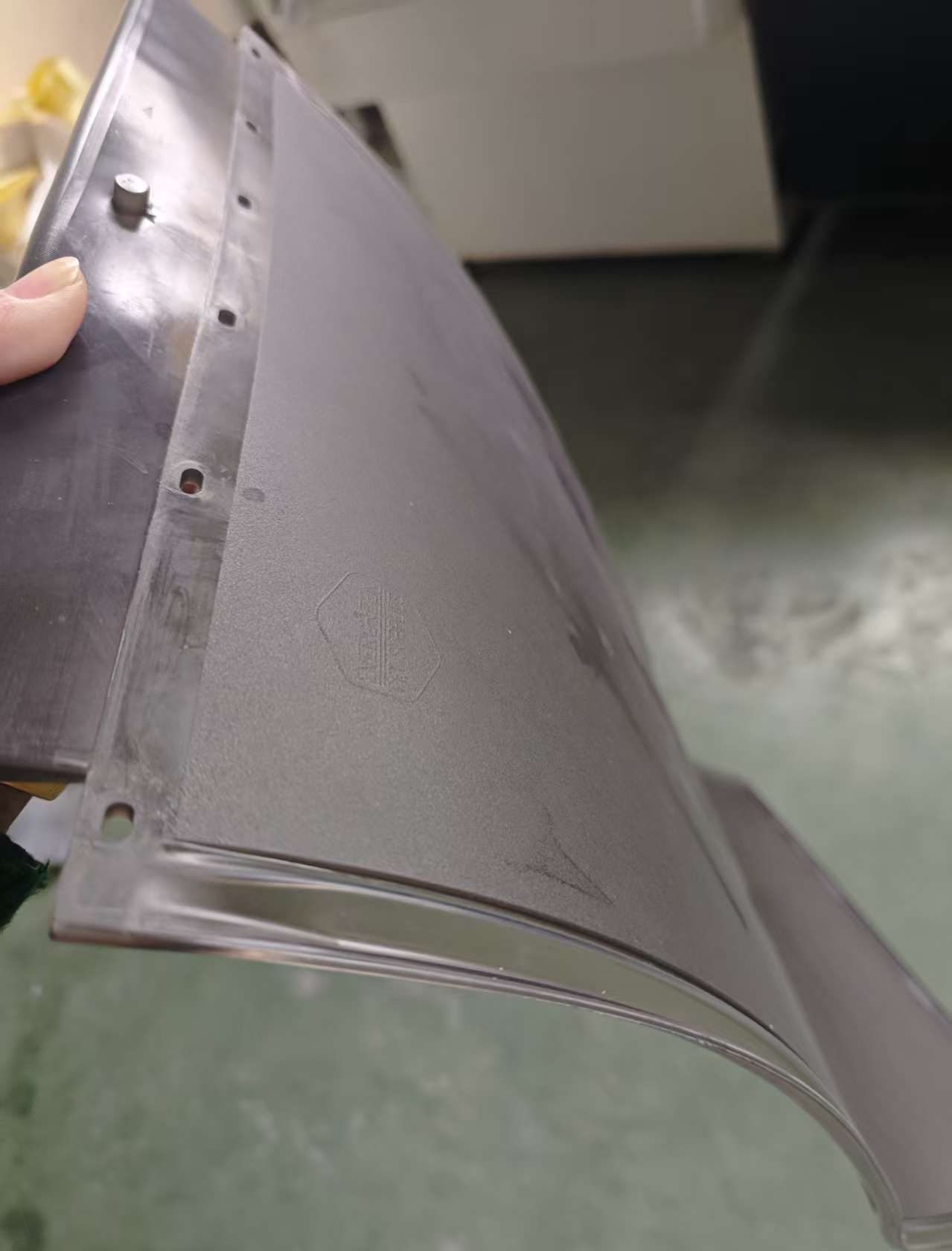

Future Growth Drivers: The next wave of demand is shifting toward industries supporting national strategies, such as new energy (photovoltaic backsheets, hydrogen storage/transport), semiconductors, and medical health. Formulating granules that meet the precise performance standards for these applications is key.

🌱 The Non-Negotiable Green Shift

Environmental regulation is not just a constraint but a catalyst for industry upgrade.

-

Eliminating Hazardous Substances: The phase-out of toxic additives is an urgent task. This includes replacing lead-based heat stabilizers with alternatives like calcium-zinc or rare-earth compounds, and accelerating the substitution of mercury catalysts in the calcium carbide process.

-

Embracing Circularity: Globally, the industry’s future is tied to building a circular economy. This involves developing technologies for efficient sorting, separation, and advanced recycling of PVC waste. Preparing for systems like the Digital Product Passport, which tracks a product’s environmental data throughout its life cycle, is also becoming important.

In summary, for Shandong Dingshengtong (DST PVC), the path forward involves a decisive pivot from being a general-purpose supplier to becoming a solutions provider focused on high-value specialties, green manufacturing, and global market agility.